THE COST

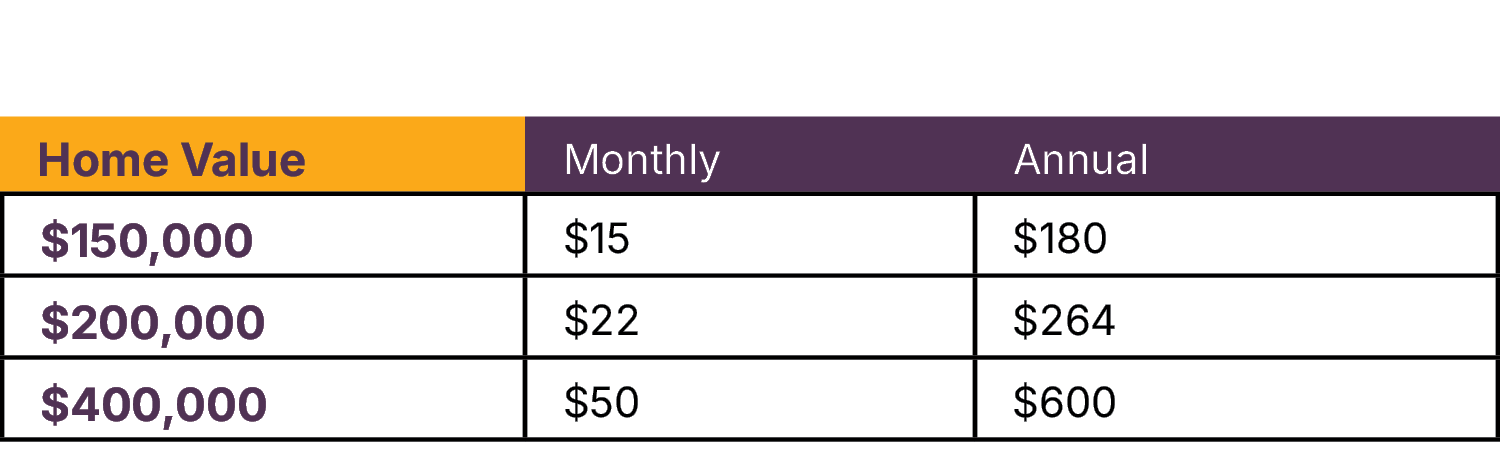

Tax Impact

Our schools are aging and in need of extensive repairs.

Repairs to public facilities that aim to keep them going for decades longer are not inexpensive. We understand that this investment is a sacrifice for taxpayers, which is why this request is smaller than in previous referendums.

Calculating tax impact is far from simple. Please use the tax calculator below to learn the impact to your property.

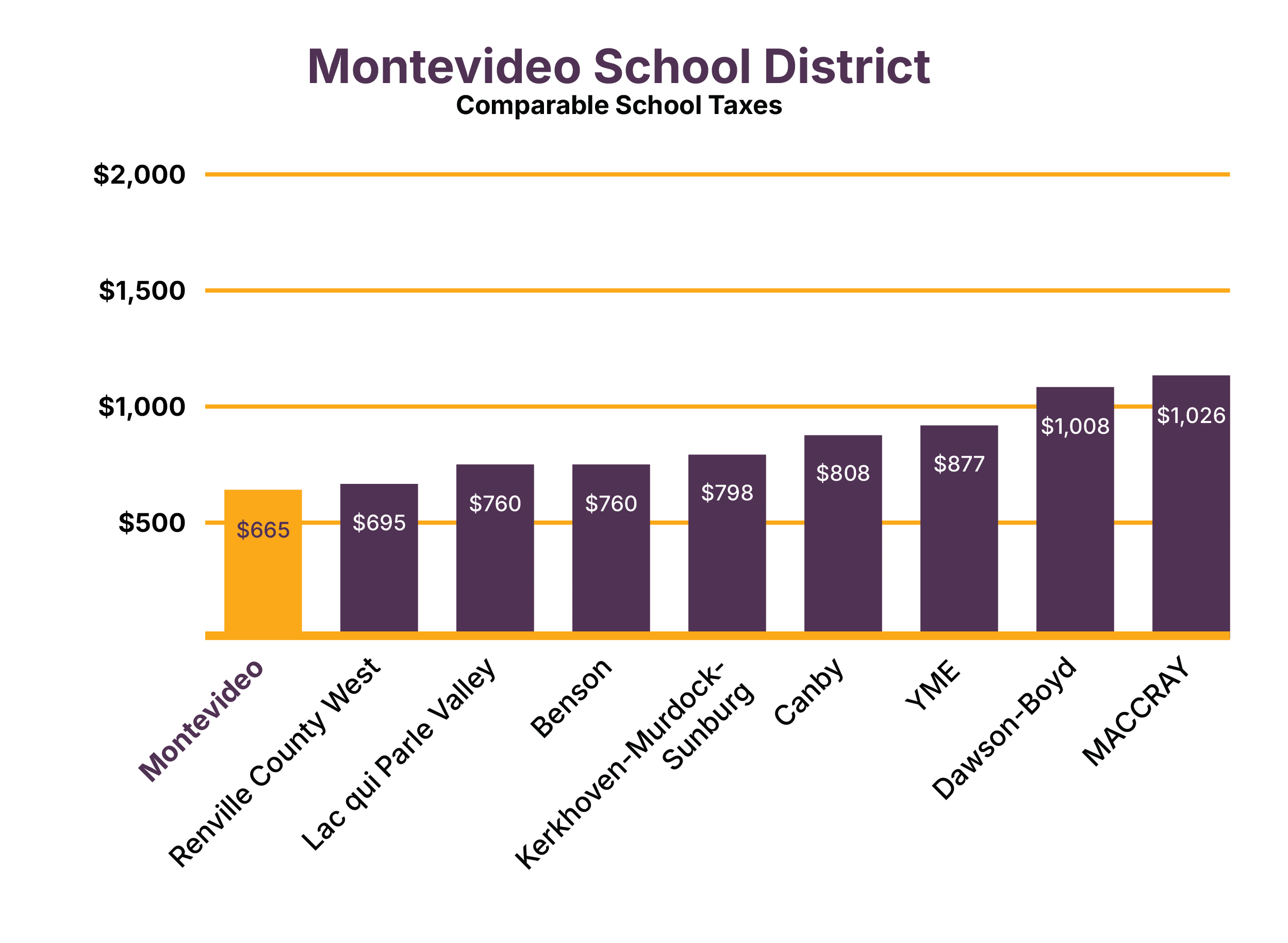

Also, see below for a comparison of total school taxes paid in neighboring school districts, and see an explanation of how you may be able to minimize your tax liability.

The cost to an average/median home is less than a weekly pizza dinner.

$22

Calculate your Personal Tax Impact

Click to visit the tax calculator and determine the specific tax impact for your home and agricultural property.

The state of Minnesota will pay for approximately $15 million of the bond amount with property tax credits for agricultural property through the Ag2School program.

Montevideo has the lowest school taxes in the region and is well below the state average.

Operating costs will be reduced.

Updated systems will reduce utility costs.

Updated facilities will reduce maintenance and repair costs.

Operating a single facility provides staffing efficiencies.

Additional Tax Relief Available

The MN Department of Revenue says many property owners qualify and don’t do the paperwork to claim the following refunds:

Homestead Credit Refund

Available for all homestead property*, both residential and agricultural - house, garage and one acre (HGA only). Refund is sliding scale, based on total property taxes and income (maximum refund is $3,310 for homeowners and $2,640 for renters).

Special Property Tax Refund

Available for all homestead property*, both residential and agricultural (HGA only) with a gross tax increase of at least 12% and $100 over prior year. Refund is 60% of tax increase that exceeds greater of 12% or $100 (max $1,000)

Senior Citizen Property Tax Deferral

Allows people 65 years of age or older with household income of $96,000 or less to defer a portion of property taxes on their home. Deferred property taxes plus accrued interest must be paid when home is sold or homeowner(s) dies.

Learn More!

Visit the Department of Revenue website at www.revenue.state.mn.us for more information

*Homestead property is physically occupied by the owner or owner’s qualifying relative as the principal place of residence.