FAQs

Frequently Asked Questions

FAQs

Q. What makes this referendum different from the last one?

A. This referendum represents a more focused, fiscally responsible approach:

Smaller investment, bigger impact. We've significantly reduced the dollar amount from the previous bond referendum, ensuring we're asking taxpayers only for what's truly essential.

One clear question. Instead of a complex ballot with multiple items, voters will answer a single, straightforward question—making it easier to understand exactly what you're voting for.

Strategic priorities. We've listened to community feedback. This referendum focuses on critical facility needs and does not include a new elementary school, keeping the scope manageable and costs down.

The result? A streamlined proposal that addresses our most pressing needs without overreaching.

Q. What if the referendum doesn’t pass?

A. The issues our school faces will not go away. Safety and security concerns will remain in our entryways, plumbing in the high school will continue to deteriorate. We will not have ADA compliant seating in our gymnasium, nor ADA access in our weight room and bathrooms in our high school. The high school cafeteria will remain crowded and inefficient. Our storm shelter in the high school will not meet MDE recommendations. The public and students will not benefit from an auditorium. The high school will have undersized educational spaces in its library, family and consumer science classroom/lab, and band and choir. The only change over time will be that construction costs will continue to rise.

Q: Why doesn’t the district have a detailed breakdown of an estimate of construction costs?

A: We cannot develop full construction documents before the referendum because:

Full construction documents would cost over $1.5 million without knowing if the community supports the project

Bidders cannot realistically hold prices for 6+ months before a February vote

Bidders could build major inflation cushions into their bids, driving costs up

The district would risk wasting significant taxpayer money if the referendum doesn't pass

Our $42 million budget comes from years of work with our educational facility experts (RA Morton Construction and Bray Architecture). Their extensive knowledge and expertise in the design and construction of school facilities - including site assessments, cost modeling, and estimating - is unparalleled.

Q: How will the district handle parking for the new Performing Arts Center?

A: Montevideo High School's current parking lot, built last summer, has capacity for 100 cars. The district has discussed adding parking on the west side of the site but is taking a practical, cost-conscious approach to meet parking needs.

The district provides sufficient parking for most typical PAC events (school performances, community theater, smaller concerts) using the existing 100-car lot, while accepting that a few high-attendance events each year may require overflow parking in other lots and on city streets. This strategy avoids the significant ongoing costs of building and maintaining a large parking lot that would sit mostly empty throughout the year and cause recurring expenses.

Q. Why is a Performing Arts Center needed?

A. Our students and community deserve a proper venue for performances, presentations, and gatherings. Right now, we don't have one.

The community has spoken. A 2024 survey showed strong support for an auditorium, and staff studies confirmed what many already know—we're missing a critical space for learning and community connection.

Educational benefits. A Performing Arts Center enhances student learning across music, theater, speech, and presentations, giving students real-world experience in professional-quality facilities.

Community asset. Beyond school hours, this space serves the entire community—hosting local events, performances, meetings, and celebrations that bring people together.

This isn't just about having a stage. It's about creating opportunities for our students to shine and giving our community a gathering place it currently lacks.

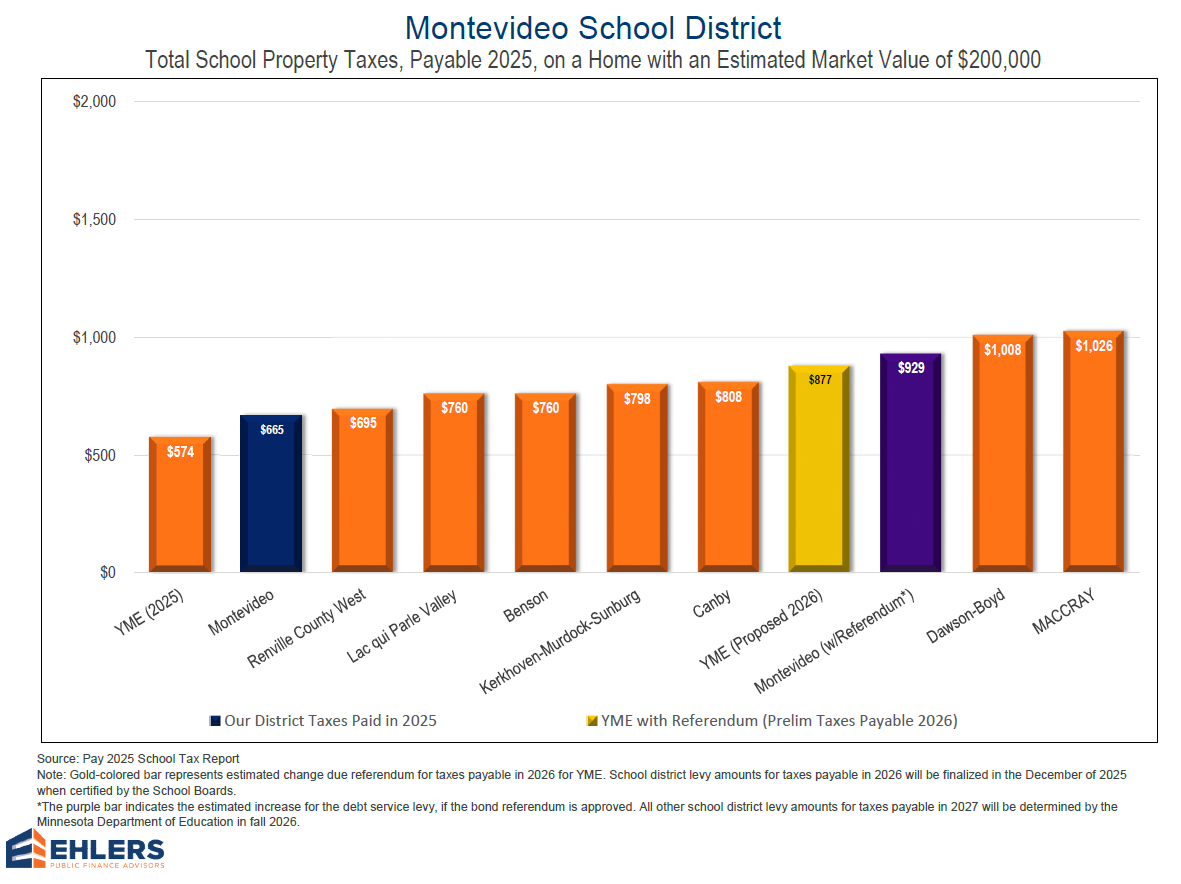

How will Montevideo total school taxes compare to nearby schools if the referendum is approved?

A. Montevideo’s total school taxes will increase for residences to the third highest of our neighbors, above Yellow Medicine East which just passed a bond referendum.

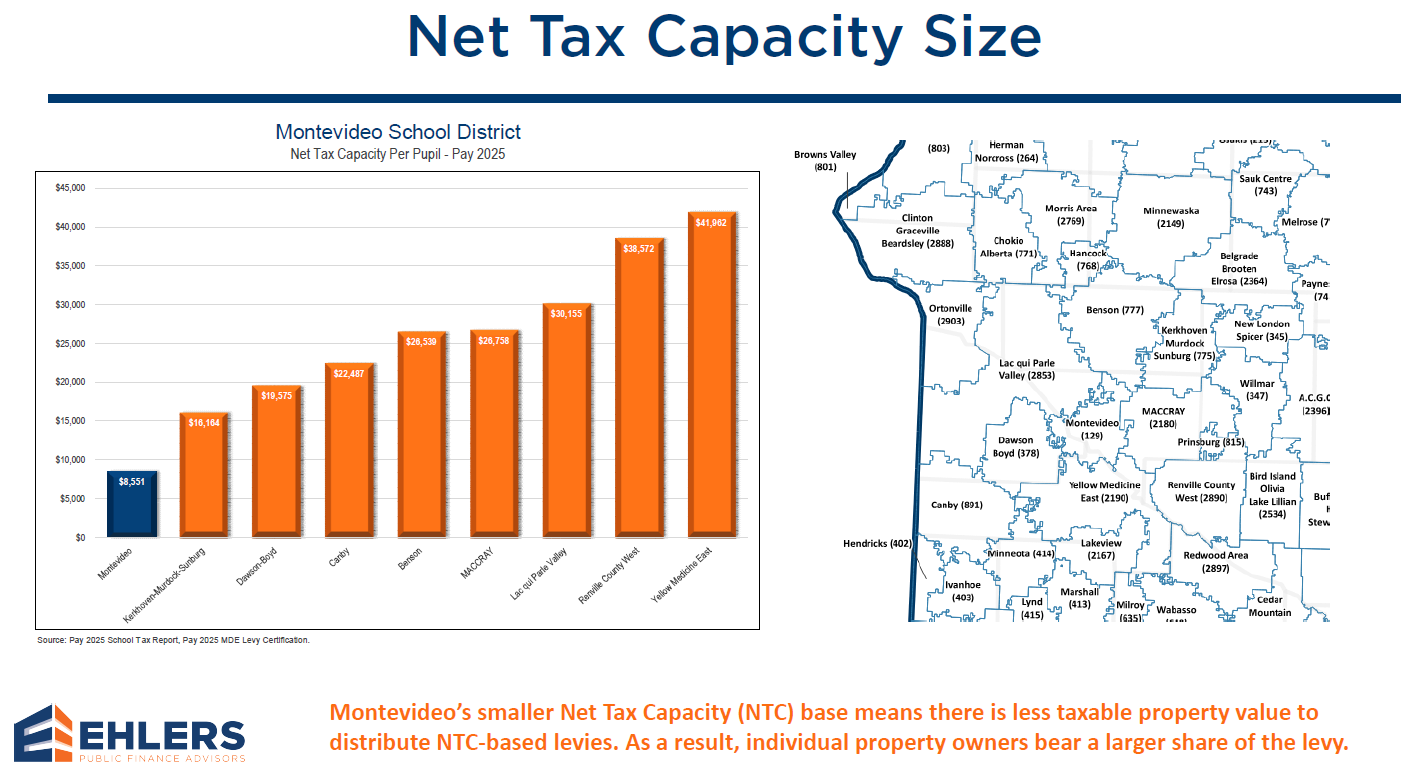

Why would Montevideo taxes be higher for my home than a similar home in the Yellow Medicine East school district when they passed a $74 million bond and Montevideo is asking for $42 million?

A. The Montevideo school district has a smaller Net Tax Capacity (NTC) base than Yellow Medicine East (YME) and other nearby school districts. This means there is less taxable property value to distribute NTC-based levies. In this bar chart, notice that the total property value is much higher in YME than in Montevideo. This is primarily due to the geographic sizes of the two districts – YME is approximately 415 square miles while Montevideo is approximately 186 square miles. As a result, a smaller number of individual property owners bear a larger share of the levy in Montevideo.

Q. Why aren’t you doing more with the elementary schools?

A. We have been engaging with community members since 2020 when we first ran a referendum to address facilities. Based on community input during referendum information campaigns and a 2024 community survey, it was clear to us that the community prioritizes a new performing arts facility and renovations at the high school, along with safe entrances to the other schools. While the elementary school facilities do have significant needs throughout the buildings, the most important needs of secure entryways would be addressed if the referendum is approved.

Q. Can the school district pay for plumbing issues at the high school through a school board approved levy?

A. No, Montevideo does not have additional levy authority to address plumbing issues at the high school.

The district lacks direct levy authority for plumbing repairs at the high school due to Minnesota statute restrictions. While the state allows districts to issue abatement bonds for parking lot construction and renovation, plumbing improvements don't fall under any available levy authority.

Q. Why was the district able to fix the parking lots without a referendum?

A. Minnesota statutes specifically grant school districts abatement levy authority for parking lot projects, which includes both new construction and renovation of existing parking facilities. This authority recognizes parking lots as essential infrastructure that requires ongoing maintenance and periodic replacement due to weather damage, deterioration, and changing accessibility requirements. The 2025A bonds utilized this authority to fund parking lot improvements across multiple district sites, addressing issues such as pavement degradation, proper drainage, ADA compliance, and safety concerns like adequate lighting and traffic flow.

How the 2025A Bonds Were Structured:

The district worked within these constraints by funding:

Health & Safety projects - Gym improvements at the high school (not plumbing)

Abatement authority - Parking lot projects across district sites

The Result:

The plumbing issues remain unaddressed. To fund these repairs, the district would need to find alternative sources such as the general fund, pursue grants, seek changes in state law, or identify a different bonding mechanism that covers this type of infrastructure work.

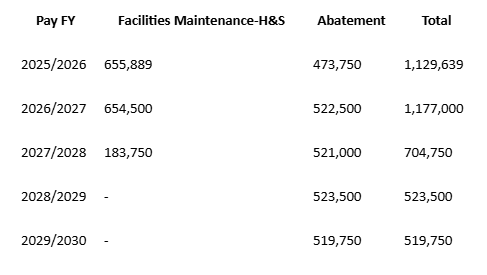

The 2025A bonds served two purposes:

Addressing health and safety projects at the high school, specifically improvements to the gym.

Funding parking lot projects at various district sites, utilizing the district's abatement levy authority for parking facility improvements.

Here is the repayment schedule, which is also summarized in the Review and Comment document. Please note that districts are required to levy 105% of principal and interest, so the actual levies will be higher than the amounts shown.

Q. Is what the bond looks like already decided?

A. A facility framework has been in development since October 2024, and there is an overarching plan identifying the major areas the bond dollars would support. Detailed planning would begin after the passage of the referendum, and would incorporate feedback from school staff and community members.

Q. Did the district reduce the bond amount just to help it pass?

A. The district refined the scope based on community feedback, cost sensitivity, and prior voting outcomes. The goal is to bring forward a proposal that addresses facility needs, while being responsive to the financial concerns that were raised in prior referendum discussions.

Q. Why is there only one question on the ballot?

A. The structure reflects a desire to present a clear, unified facilities plan.

Q. Can the District provide tax impact calculations for agricultural properties?

A. We recognize that farmers are detail-oriented, and we appreciate the desire to understand exactly how a referendum might affect agricultural land, homesteads, and rented acres. However, it is important to clarify the district’s position:

The district cannot provide individualized property-tax calculations.

There are too many variables outside the school levy itself, valuation changes, classification differences, credits, and other local levies.Taxpayers with specific scenarios should consult their tax advisor, accountant, or the county assessor’s office.

These professionals can apply the Agricultural Bond Credit, market value adjustments, and individual parcel specifics more accurately than the district is legally able to.The district will provide general information, including how the agricultural bond credit works and examples of how bond levies are calculated, but these will remain generalized because we cannot account for each taxpayer’s unique situation.

Q. What other needs have been identified within the district?

A. In addition to needs addressed in the proposed plan, Bray Architects conducted a facilities study and found the following to be in poor condition, which will need to be addressed in a second phase:

Sanford Education Center: Plumbing, Life Safety

Ramsey Elementary: Plumbing, Life Safety, Exterior Doors, Overall Exterior Windows

Montevideo Middle School: Plumbing (Hot Water System)

Phase two will likely include the construction of a new elementary school on the south campus that will house all Pk through 4th grade students. The school district will consider these facility needs in the future.

Q. Does farm property receive some tax relief?

A. Yes, for decades, farm families paid school operating levies on 1 acre of property that included the house, but paid school bond levies on all property. In 2017, the Minnesota Legislature approved a 40 percent tax credit for farm land school bond taxes. In 2019, the legislature approved higher tax credits to be phased in over time:

50 percent in 2020

55 percent in 2021

60 percent in 2022, and

70 percent in 2023 and after

Q. Can the state change the Ag2School credit?

A. In the past, landowners have questioned the sustainability of a program that provides this significant tax benefit. While the state legislature has the ability to make changes to any aspect of school funding including this program, there are a couple of factors that give us confidence that this program is here to stay. First, the program has been implemented and expanded with bipartisan support. Second, the state of Minnesota has a long history grandfathering in programs so that when funding formulas change, those school districts who currently benefit do not lose funding but it may not be available for the future

Q. Does increasing funding for schools have any effect on academic outcomes?

A. The most rigorous research shows that, as scholars C. Kirabo Jacson and Claudia Persico put it, “there is a strong causal relationship between increased school spending and student achievement.” To read the scholar’s review of that research, please visit https://onlinelibrary.wiley.com/doi/epdf/10.1002/pam.22520

Q. I don't have kids in school. Why should I care about this?

A. Strong schools help support a strong and vibrant community. Local community and business leaders are active in our schools and will help guide future decisions. We are all dependent upon the outcomes of all schools, and Montevideo is no exception. We must educate the next generation to sustain our community.

Q. What is the difference between a bond and an operating levy?

A. Bonds are for buildings. Levies are for learning. An operating referendum is an election asking voters to provide funds that the district uses to run and operate its schools. An operating levy is for running the educational programs at the school and goes to the district’s general fund to support students. Bond levies are for funds that the school district uses for new construction, updates to existing facilities, and other additions to school properties. Each fund remains separate and cannot be used for another purpose.

Q. Can I deduct the taxes paid on my State and Federal Income Taxes?

A. If you itemize deductions for federal income taxes, you may deduct all property taxes paid.

Q. How do schools impact the community?

A. According to the National Bureau of Economic Research, there is a definite correlation between school expenditures and home values in any given neighborhood. A report titled, “Using Market Valuation to Assess Public School Spending,” found that for every dollar spent on public schools in a community, home values increased $20. These findings indicate that additional school expenditures may benefit everyone in the community, whether or not those residents actually have children in the local public school system.